The backtest on the left only factors in a 2-pip spread, producing an expectancy of about 2.5 pips. If your backtest expectancy is only 1-2 pips, any unexpected increase in trading costs could turn a profitable strategy into a loser.Ĭheck out the GBPNZD scalping strategy below. A common development pitfall is to select short indicator lookback periods, leading to high trading frequency and a low expectancy. I do pay attention to the expected payoff though it should comfortably cover transaction costs in the form of spread, slippage and commissions. It suffers from the same drawbacks as net profit. Expected PayoffĪlso known as the expectancy or the average trade, this is the net profit divided by the number of trades. Nonetheless, the profit factor is normalized and is a good choice when doing quick comparisons between strategies. The first only has a 10% drawdown, whereas the second has a 30% drawdown due to a losing streak early in the backtest. The two equity curves below both have a profit factor of 1.6. Having a string of losses in tight succession could decimate your account. The relative balance between profits and losses provides some indication of your strategy’s risk, but tells you nothing about the sequence of losing trades. Profit factor is defined as the gross profits divided by gross losses. Longer backtest periods are always favourable since they produce more trades and cover more market conditions.Īs a first pass, I consider any backtest containing fewer than 250 trades to be highly suspicious. When selecting your trading timeframe and backtest period, the number of trades in your backtest should be a key consideration. You can use the standard error to quantify the uncertainty arising from a small number of trades. The more trades you have, the more reliable your backtest statistics will be. While not a performance metric per se, it is crucial for the statistical significance of your backtest. When you’re trading live, you need to trade through the drawdowns to realize the eventual profits. If you consider profits in isolation, there is no way of answering these questions in real-time.īacktests provide the benefit of hindsight. If you enter a prolonged drawdown, what are the chances that your strategy will recover? Is it broken? Net profit fails both of the above conditions.Īlthough profit and drawdown usually have an inverse relationship, some estimate of the strategy’s historical drawdown is required when evaluating your strategy’s live performance. Examples would be the Sharpe ratio and profit factor. We’ll go through the differences later.Ī normalized metric allows convenient comparison across different markets and strategies. Numerous measures of drawdown exist, the most common of which is the maximum drawdown obtained over the backtest period.Ĭonsidering the importance of this metric, MT4 provides the maximum drawdown in both dollar and percentage terms.

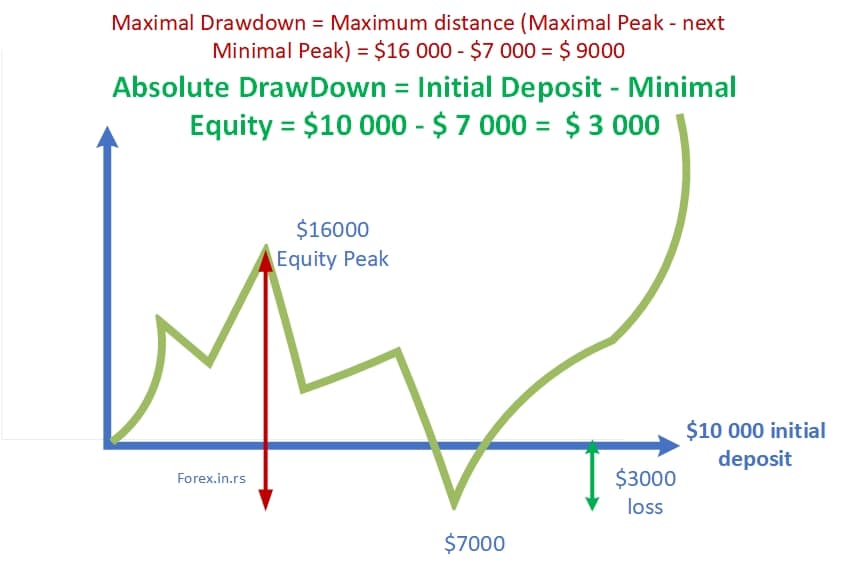

Risk management is often a central focus of successful trading.ĭrawdown is often used to quantify risk, and is defined as a peak-to-trough equity drop. Surely some metrics are more important than others.īut before figuring out which metrics we should pay attention to, we first need to know what to look out for.Īt the minimum, a good metric should satisfy the following two conditions: The optimizer reports, in particular, will likely occupy much of your attention.ĭo you really need to pay attention to every metric? Every automated forex trader has combed through an MT4 backtest report at some point.

0 kommentar(er)

0 kommentar(er)